You may wonder, “Why is bookkeeping important for a small business?” If you’re just starting out, shouldn’t it be low on your priority list? That begs the question, “Why is accounting important in business?” Or, for that matter, why is record keeping important in general?

In this post, we’re going to go through 10 reasons why bookkeeping is important as a regular practice. Whether you run a small or large business, it matters a lot!

1. Budgeting and Planning

Benjamin Franklin famously stated, “By failing to prepare, you are preparing to fail.” Planning is vital to the growth of any business. Budgeting is just one part of planning – the financial aspect of it. When you think about bookkeeping, it is basically the practice of keeping track of something. You write it in a book to keep the information, so you don’t forget. Today, we understand bookkeeping to mean specifically noting down what goes out from and comes into your business, financially speaking.

You need all this financial information to create a proper budget for your business, and for yourself. Your money as the business owner depends on the money that comes out of the business. Your budget, therefore, depends on the planned share that you get from the business’s revenue. When you fail to keep the books, you will either fail to plan or create a plan that will fail.

2. Decision Making

Like planning for the business budget, most decisions that you will make for your business involve finances. Money is what will enable you to keep your business running, or do more. So, why is bookkeeping important for a small business especially? You need to see exactly where every penny is going if you want to beat the odds and survive.

90% of startups fail. 20% of these are just within the first year, and the odds of failure increase over time. Why? 16% are directly financial problems. However, every other problem that leads to business failure has a financial component. Take, for example, lack of product market fit and team problems. These can come about because the company didn’t have enough money to conduct proper research. Tech and marketing problems can be a lack of budget for proper tools and implementation. The same goes for operations and legal as they relate to engaging skilled help.

3. Financial Control

I have another famous quote for you: “Knowledge itself is power.” This one is from Sir Francis Bacon, who wrote this over 400 years ago. This established our modern idea that having information is having power because this influences success and failure. I’m assuming that you as a business owner want to achieve great things in business. If that’s true, you need to know the information that will give you control. The most important chunk of this information is financial data.

4. Cash Flow Management

Cash flow management is what we call the process of what I described above. It’s all about planning, tracking, and controlling how money is moving through your business. This means that you are looking at data to learn the future needs of the business. More importantly, you are planning ways to make sure you have enough funds available for them. When you have extra cash, managing it helps you maximize its value. Here, we can ask, “Why is double entry bookkeeping important, more specifically?”

Double entry bookkeeping is a tidier and stricter form of record keeping. It helps you see the details of debits and credits in liability accounts, equity accounts, and assets at the same time. This, in turn, helps you maintain proper cash flow management to make the best possible plans. In essence, it’s what keeps your business financially stable so you can not only survive but grow strong. Cash is vital, helping you avoid deadly issues like defaulting on loans and eventual bankruptcy. You can’t pay people with promises, after all – whether they’re suppliers or back-office help.

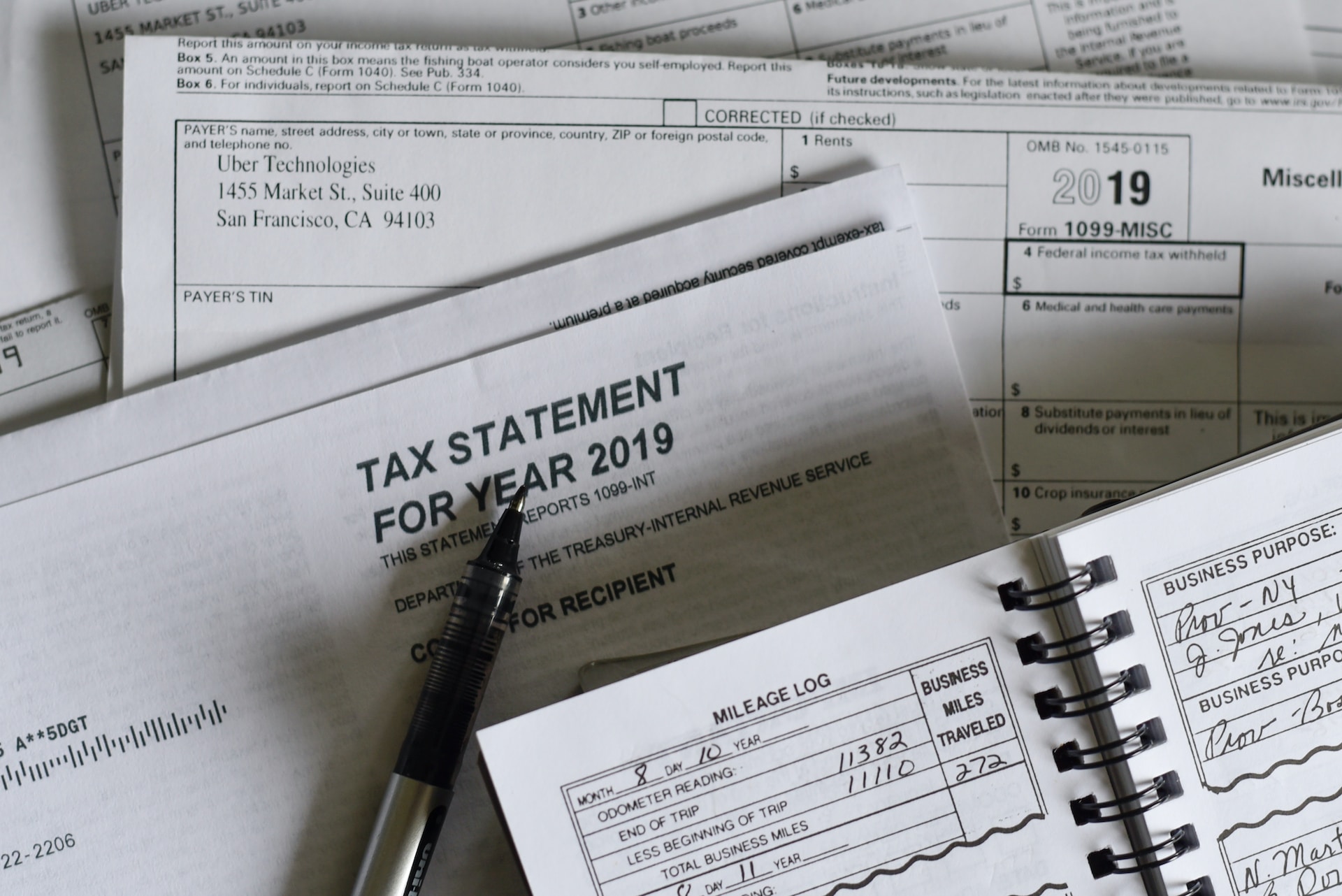

5. Tax Compliance

This is a great opportunity to answer the question, “Why is accounting important in business?” Simply put, you need to have accurate accounting to be tax compliant. To have accurate accounting records, you must keep accurate books. You can’t pay the correct taxes otherwise. This is because you need to know the amount you’re supposed to pay taxes on.

Basically, the taxes you pay as a business are based on percentages of your income, minus tax deductions from expenses. This means that you must have the correct details of money in and money out. Then and only then can you compute the correct taxes to remit to the government. If you don’t do it right and someone gets suspicious, you and your business could get in a load of trouble.

6. Audits and Reviews

This is the type of trouble I’m talking about! In the US, the Internal Revenue Service (IRS) is in charge of monitoring tax collection. They ensure compliance and crack down on violators. And, to be clear, the IRS can request to audit your books at random. You don’t have to actually be doing anything suspicious for them to want to take a look. If you are selected for an audit, you will definitely be in trouble if you can’t present accurate financial records. Why? Because the lack of proper bookkeeping and accounting will immediately beg the question, “How did you compute your taxes without the data?”

7. Legal Compliance

This is where you can get into a legal mess. Compliance means following all the rules, regulations, laws, and other standards. In accounting, this means everything related to honest and accurate financial reporting. You will likely have legal issues if you fail to show that you maintain clear and transparent record keeping processes. The IRS expects that you can, at any time, verify every single financial transaction. This includes revenue, expenses, assets, and liabilities.

So, why is bookkeeping important for a small business especially? For a business still in its early stages, having to pay penalties for noncompliance can mean the end. Whether you’re bootstrapping or in debt, you cannot afford another financial load. Even if you can afford the fines, noncompliance can mean business interruption. This brings indirect costs, as does the damage to your reputation. As a new business, a bad record is no way to start building a brand name.

8. Business Valuation

You might be building this business with a mind to sell it down the line. This can be very profitable. Many people want to run a business but don’t want to go through all the trouble of building it. So, you need to maintain a good reputation for your business because this affects your valuation.

Business valuation is how you decide the economic value of the business. This gives you and potential buyers a good estimate of the value of your company. This informs how much potential buyers will be willing to pay. If you have a strike on your record with the IRS, your valuation will not be good.

Maybe you don’t intend to sell, but you need investors or even just a loan. A bad record will work against you in pretty much the same way. They won’t trust you to take care of their money if you can’t even keep track of yours.

9. Employee Accountability

When you have other people involved with your business, you need to keep track of them. This is just as important as keeping track of your money. Their performance and behavior are closely tied into your business finances, after all. Most people will be tempted to dip their hands into the honey pot at one time or another. We are all vulnerable to that temptation. What happens when they see that you don’t seem to care that much about keeping track of things? Well, that temptation becomes stronger because the risk of getting caught becomes smaller. Keeping clean records keeps employees accountable because they have no room to mess around.

10. Succession Planning

Some companies use succession planning, which is a business strategy for passing down leadership roles. This is usually for when people move on to other jobs, retire, or pass away. It also applies when you prefer to promote people within the company instead of hiring for higher-level roles. We think it’s a great strategy, mostly because your people already know your business and culture. They have also been tried and tested for skills and reliability, among other important factors.

When you implement a change in leadership, things can get rough. The point of succession planning is to ensure that your business operations continue uninterrupted. So, why is bookkeeping important to something that seems totally unrelated? Because it is definitely related! First, promoting one person is not just about that one person. You must know that you can move everyone up the ranks to fill in all the vacant positions left behind. It’s like a chain reaction. So, you need to make sure that you can afford to give everyone a pay increase as they advance within the company. Of course, even if you hire for a managerial position, you still need to know that you can afford to pay the new manager!

What Is EcomBalance?

EcomBalance is a monthly bookkeeping service specialized for eCommerce companies selling on Amazon, Shopify, Ebay, Etsy, WooCommerce, & other eCommerce channels.

We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month.

You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so you and your business partners can make better business decisions.

Interested in learning more? Schedule a call with our CEO, Nathan Hirsch.

And here’s some free resources:

- Monthly Finance Meeting Agenda

- 9 Steps to Master Your Ecommerce Bookkeeping Checklist

- The Ultimate Guide on Finding an Ecommerce Virtual Bookkeeping Service

- 6 Reasons Accurate Ecommerce Accounting is Crucial for Your Business

- Accounting Basics 101: What Small Business Owners Must Know

- Generally Accepted Accounting Principles (GAAP) Cheat Sheet

- How to Read a Balance Sheet & Truly Understand It

Finally, Why is Bookkeeping Is Important?

We can name quite a few other specifics on why bookkeeping and accounting is important, especially for small businesses. However, we know that you already have a pretty good idea by now. We have done our best to emphasize how important is it to keep good records in general. Financial records are just at the top of the list of what every business owner needs to keep clean and clear. Stay compliant, stay safe!