You need to know your LLC tax rate so that you can figure out what your dues are when tax season rolls around. A mistake can mean either overpaying or underpaying on your taxes. Both are not good for your business.

Without a solid tax plan, you can even end up owing a lot to the IRS because of interest and penalties. And all of that because you didn’t know what the IRS requires you to pay in the first place. If you then don’t have the money on hand, your business could be in irredeemable trouble.

Overview of LLC Tax Rate

The usual LLC tax rate is not complicated at all, even though there are several variations of what we call LLCs. Generally speaking, the LLC tax rate for most LLCs is no different than the rate for personal federal income tax. Remembering that LLCs are a type of business structure that is established by state statute, though, the guidelines for taxation can be different from state to state.

You can look at our post on LLC Tax Filing Deadline 2024 to see the different types of LLCs and how they are taxed for more information. As an overview, however, the government considers most LLCs except for those that choose to be treated as C Corporations as “pass-through” organizations. This means that they don’t hold tax liability themselves.

Instead, they pass that off to their member-owners or stakeholders. So, LLCs don’t actually have a fixed tax rate. The rate depends on the income levels that the individual members of the LLC claim. This is because they are paying income taxes on LLC profits as personal income.

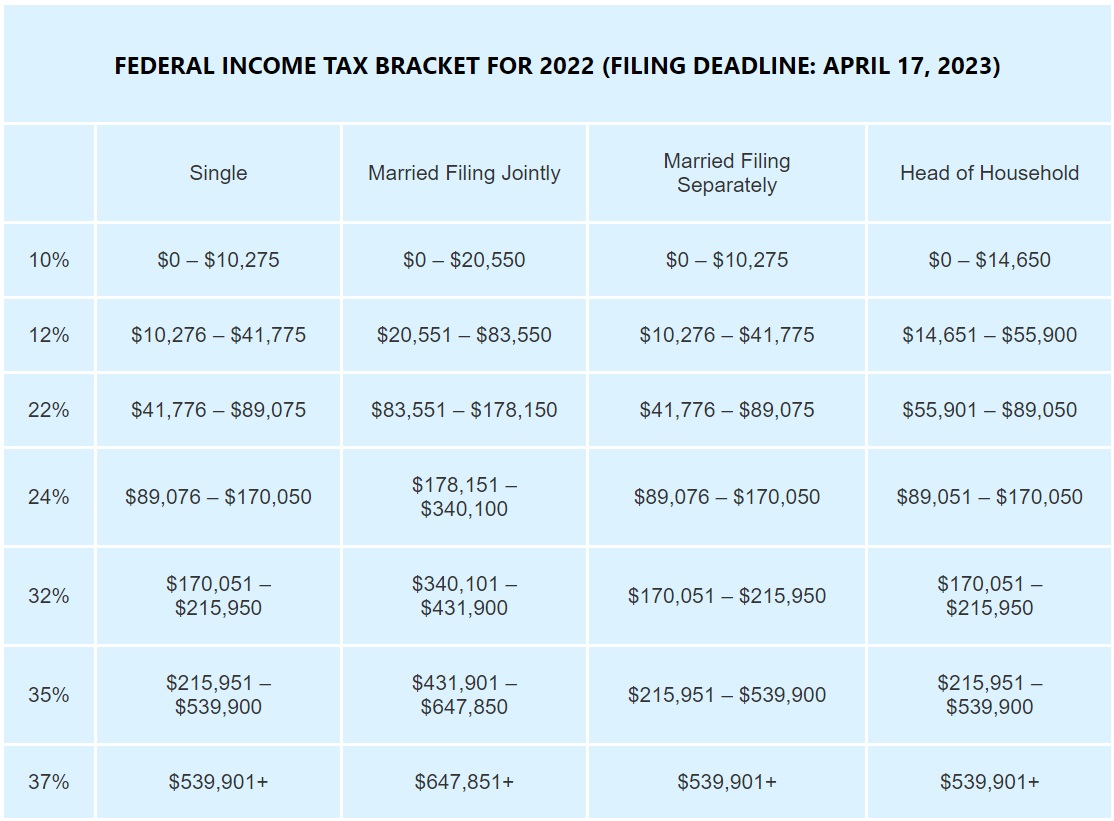

As such, we can still give you an idea of the LLC tax rate to expect based on the LLC federal income tax rate that member-owners follow. The brackets can change from year to year, but here are the latest federal income tax brackets from 2022 that were filed in 2023:

What is the Default Tax Treatment for an LLC?

So, we know that no single LLC tax rate exists because there are several LLC types. We must look first at how many member-owners you have. Then we look at what their individual personal filing status and annual income is. A few other factors can also come into play.

If you are the sole member of an LLC, your business is treated as a Sole proprietorship by default. If you jointly own an LLC with other people, it is treated as a partnership, all things being equal.

In both cases, these LLCs are taxed as “pass-through” entities, as explained above. Each member simply pays personal income taxes. Single owners will also likely pay Self-employment tax for Social Security and Medicare contributions.

You can avoid paying the business share of that if you choose to be taxed as an S corporation. LLCs taxed as S corporations use the personal tax rate, like Sole proprietorships.

We highly recommend that you get professional help from a tax expert for this. You want to make sure that you are setting up your business properly and doing all your taxes correctly.

Additional Taxes For LLCs

Apart from the general personal tax rate, which varies for individuals, LLCs pay additional taxes.

Self-Employment Tax

This federal tax applies to the income of self-employed persons. Note that this is not the same as federal income tax. Self-employment tax is a separate tax of 15.3% on personal income. Sole proprietors and most LLC members (in addition to general partners) need to pay this tax. 12.4% of this tax is Social Security tax and the remaining 2.9% is Medicare tax.

LLC member-owners pay Self-employment tax because they need to pay Social Security and Medicare taxes (also known as FICA tax). Usually, employers withhold these taxes as part of payroll taxes. Since LLC member-owners are not employees, no one is withholding the payments for these benefits on their behalf.

They are responsible for paying the tax because they don’t receive paychecks where FICA is already withheld. They don’t need to pay the whole amount, though. Like employees who pay a half share, LLC members can pay half and have the other half deducted as a business expense.

Payroll Taxes

LLC payroll taxes only apply if your LLC has employees. The Internal Revenue Service (IRS) does not recognize LLCs as business entities. This is why LLCs need to elect to be taxed as either Sole proprietorships, Partnerships, or Corporations. Sole proprietorship applies if there is only one owner. The Partnership designation applies if there are more than one owner.

Alternatively, either can choose to be taxed as a Corporation. Note that the IRS taxes LLCs as Sole proprietorships or Partnerships by default depending on the number of member-owners if they do not specifically elect one of the available options.

To pay Payroll tax, your LLC needs to have an Employer Identification Number (EIN). This is your federal tax identification number issued by the IRS. Note that single-member LLCs can opt to report and pay employment taxes using the member-owner’s name and social security number.

Otherwise, the LLC needs an EIN to report and pay using the business name. The IRS usually recommends getting an EIN, although it may not be necessary if you only have a few employees. All things considered, having an EIN for tax purposes can help you avoid some disputes and legal issues.

That said, you must withhold payroll taxes from each of your employees’ paychecks. You then pay the applicable FICA, and federal, state, and local income taxes. Other withholding taxes, depending on what state you are registered in, include disability insurance taxes and FUTA (Federal Unemployment Tax Act).

Note that the owners of unincorporated businesses are like employees. As such, they will pay the same, just as if they were the sole employee of a corporation.

Sales Tax

Apart from state and federal tax requirements, some LLCs need to collect and pay sales tax. This applies to the products and services they sell. Member-owners of the LLC must know the required sales taxes, collect them from customers or clients, and remit them to the proper offices.

The rates and policies governing sales tax vary from state to state. This refers to what you pay and when based on your registered business location. You need to check with your local offices to see what applies to your business. The rules can change, too, so make sure you stay updated – paying the correct taxes is your responsibility.

You will also see variations based on the location where your customers are purchasing from. Make sure you know which sales tax collection laws apply in these cases. A CPA is your best bet when learning to navigate these complexities.

State Taxes

As mentioned previously, the IRS looks as LLCs taxed as Sole proprietorships and Partnerships as disregarded entities. The LLC is therefore not required to file a separate income tax from the owner-members. This works the same, for the most part, at the state level as it does at the local level.

The tax applies to only the income that is attributable to a specific locality or state. The LLC is taxed by a state based on the number of sales made, the assets owned, and the payroll paid in that state. Note that California does not continue with “pass-through” taxation on LLCs but charges additional taxes.

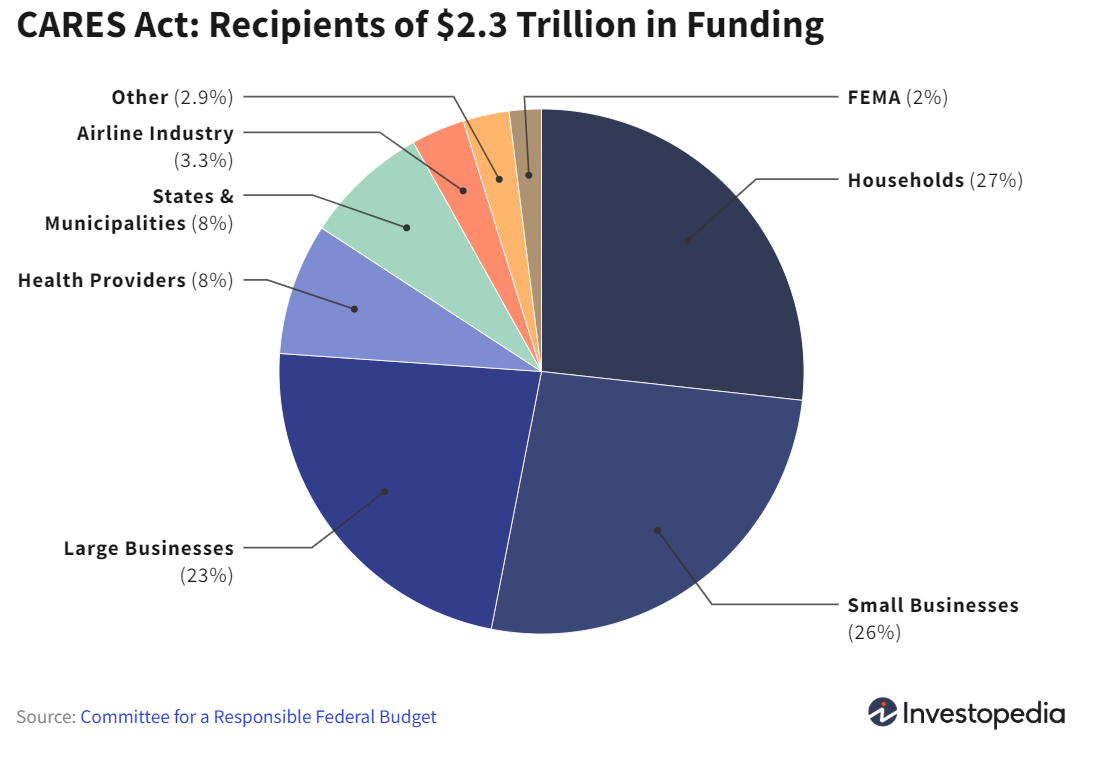

What is the CARES Act?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is a $2.2 trillion stimulus bill. It’s the biggest financial rescue package in the history of the United States.

Congress passed it and President Trump signed it into law in March 2020 This legislation directed government funds to help smooth out the damage to the economy resulting from the coronavirus pandemic.

It targeted families with children, furloughed workers, independent contractors and gig workers, small businesses, large corporations, the health care system, etc.

Does the CARES Act Impact LLC Taxes?

Key provisions of the CARES Act aim to help Sole proprietorships, Partnerships, and S-corporations. The benefits were to aid these businesses in generating cash flow and liquidity. The point is to help keep these businesses open and employees employed.

The provisions included:

- Payroll Tax Credit for Employers

- Payroll Tax Payments Delays

- Modifications for Net Operating Losses

- AMT

- Increased Interest for Business

- Qualified Improvement Property

- Alcohol excise tax

For more details, check out this CARES Act Impact On Taxes post.

What Is EcomBalance?

EcomBalance is a monthly bookkeeping service specialized for eCommerce companies selling on Amazon, Shopify, Ebay, Etsy, WooCommerce, & other eCommerce channels.

We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month.

You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so you and your business partners can make better business decisions.

Interested in learning more? Schedule a call with our CEO, Nathan Hirsch.

And here’s some free resources:

- Monthly Finance Meeting Agenda

- 9 Steps to Master Your Ecommerce Bookkeeping Checklist

- The Ultimate Guide on Finding an Ecommerce Virtual Bookkeeping Service

- What Is a Profit and Loss Statement?

- How to Read & Interpret a Cash Flow Statement

- How to Read a Balance Sheet & Truly Understand It

Conclusion

You can end up paying heavy fines and penalties if you fail to pay taxes, even if you miss one tax payment. This is why we stress getting expert help to ensure that you correctly calculate your taxes owed and pay them all on time and in the right way. You should also know all the available benefits, which only the professionals know how to properly navigate.