Do you know what kinds of Amazon seller tax documents you need for your store? Well, first, you need an understanding of your tax obligations as an Amazon seller. In this post, we’ll get into that, then explain the tax documents you will integrate into your accounting routine. You will want to pay close attention to how to use these documents, because some Amazon seller tax mistakes can really cost you.

Understanding Amazon Seller Tax Obligations

Like every other online seller, Amazon sellers have tax obligations. The 2024 deadline for businesses taxed as partnerships to file their taxes is March 15th. The filing deadline for businesses taxed as corporations is April 15.

Sales Tax and Income Tax

Ecommerce businesses must accomplish this yearly reporting of earnings to the Internal Revenue Service (IRS). But, that’s not all they need to do. Most businesses must also collect sales tax on purchases. In the US, sales taxes vary from state to state and even city to city. This rate range applies to both the location of the customer and the warehouse that the item comes from. The sales tax rate on FBA sales can therefore be anywhere from 0% to 13% for each transaction. That equates to a lot of computing to figure out how often to file and pay. Plus, businesses need to register with each state’s tax authority to remit these taxes.

It’s a good thing, then, that Amazon automatically calculates, collects, and remits sales taxes for marketplace sellers. In addition, only Professional Sellers need to deal with sales tax on Amazon. This is because of the Marketplace Facilitator Law which applies in most states. This law means that the marketplace, or Amazon, is totally responsible for collecting and remitting sales tax. Third-party sellers are off the hook. All they need to do is track and report sales taxes, correcting any errors in the process. All the details of these sales tax reports are in Seller Central.

Sales taxes are computed based on revenue. Income taxes are computed based on profits. Sellers pay income taxes to the federal government via the IRS, but also possibly to a state government.

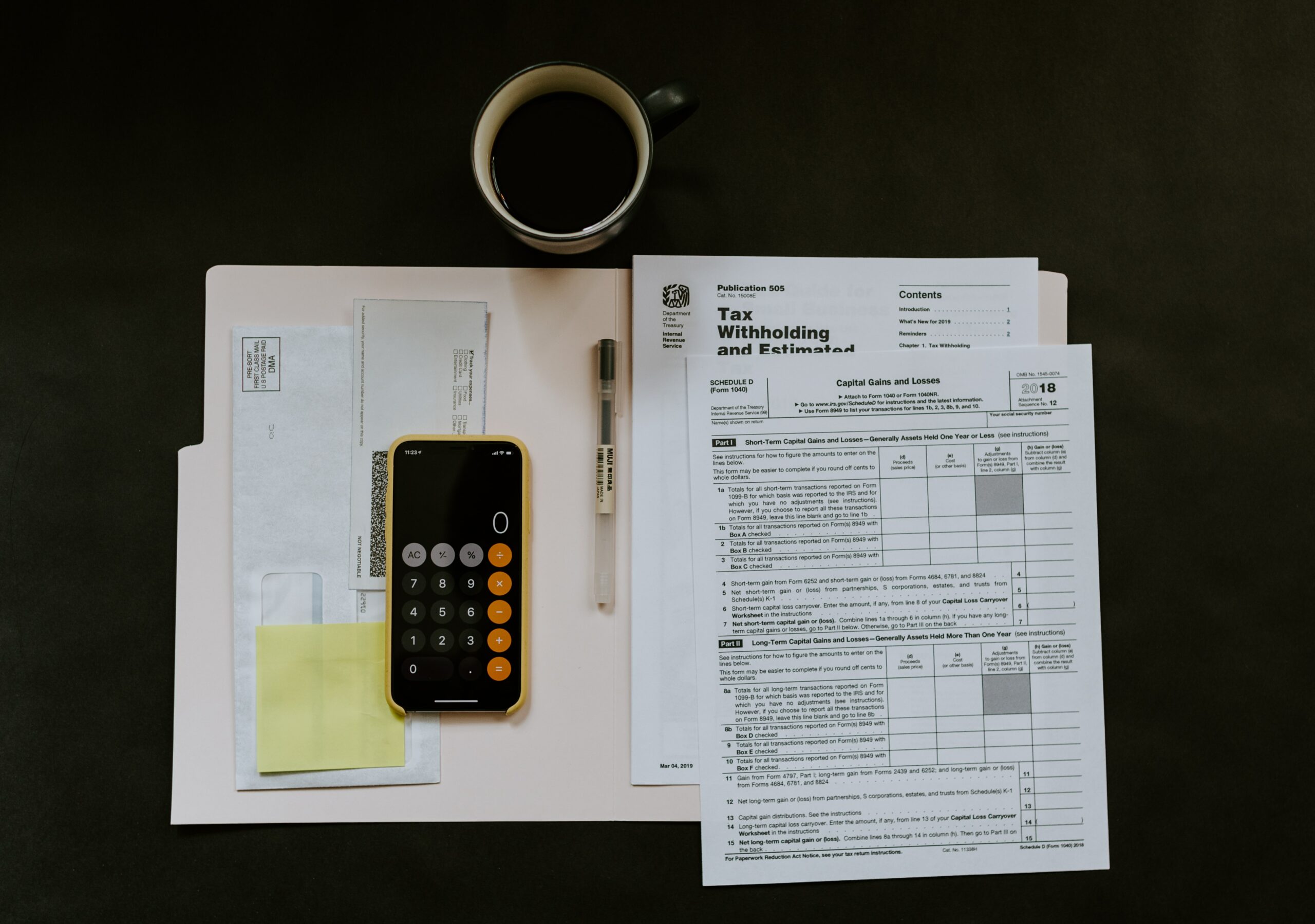

Key Amazon Seller Tax Documents Explained

The Tax Document Library in Seller Central will provide all the Amazon seller tax documents you need. Amazon will usually have them ready for you to download based on what your eligibility is. As mentioned above, however, you should always double check because Amazon isn’t perfect. You don’t want to get into trouble with the IRS!

If you did not agree to get your forms electronically, Amazon will most likely send them to you by postal mail.

Form 1099-K

Amazon and similar businesses issue the 1099-K form. It’s a sales reporting form that gives the IRS data on annual and monthly gross sales. This data comprises sales tax, shipping fees, and more. Amazon prepares this form for all individual and professional Amazon sellers. As long as you meet the requirements, Amazon will also take care of sending the completed document to you and the IRS.

That said, we must note that not all active sellers on Amazon get a form 1099-K. Sellers must gross at least $20,000 in total sales spread over at least 200 transactions. Sellers with over 50 individual transactions will not get a 1099-K, but they must still present Amazon with their tax status. Otherwise, Amazon can revoke their permission to sell on the marketplace. You should find the process of providing your tax information pretty easy since you can upload it straight on your Seller Central account.

If you do meet the qualifications for a 1099-K, Amazon probably emailed you. If you did not get a notice about it, you can locate the form in Seller Central. While logged in, navigate to the Reports menu. Choose “Tax Document library” and locate the 1099-K form for the current year. You can then download and print it out for your records. If you didn’t get one and you think you should have, contact Seller support.

Filling out Form 1099-K

When you get the form, make sure that you thoroughly check its contents. This is because you are responsible for any mistakes on it. (Yes, Amazon does make mistakes sometimes, but they won’t suffer for this one.) If you notice errors on your 1099-K form, you need to correct them. Here’s how to make sure that your 1099-K correctly reflects your unadjusted total gross sales for the whole year:

First, note that your annual unadjusted total gross sales is based on product ship dates and not the dates you sold them. With that in mind, you can calculate your unadjusted gross sales. You can find that information in your Seller Central date range report. You want to generate the summary report type of that statement. Make sure you have the correct reporting date range before you hit “Generate”. Once you have it, you can add up all the amounts from the two charts. The sum of what’s listed is your unadjusted gross sales.

1099-MISC

Some US sellers will need to turn in a Form 1099-MISC, too. This form reports other income they may be getting, like commissions, that come in from sales made on Amazon.

Form 1040 and Schedule C

Form 1040, also known as a Schedule C, is what individuals use to file federal income tax returns. It reports your individual gross income for the whole year. It also notes how much of that gross income is taxable after subtracting tax credits and deductions.

You do not necessarily have to have a business license to sell on Amazon. It depends on your state laws. So, if you run the store as an individual, you will use the 1040 form. This is as long as you don’t have an office and employees and all that. We also recommend that you do get a license, specifically incorporating as a Limited Liability Company (LLC). Forming an LLC protects you as an individual from personal liability in case your business has financial issues. An LLC is also great for working out taxes because you can deduct a lot of expenses, known as business write offs.

The Schedule C is an additional form that goes with the Form 1040. It has the summary of your business numbers alongside tax details that go on your personal tax return. This is how many LLCs as well as sole proprietorships file their taxes.

Form 1120 and 1120S

Other businesses will file income taxes using Form 1120. These include businesses formed as partnerships and C corporations and LLCs that file as corporations. S corporations need to use Form 1120S. Business owners will also use the additional K-1 form for personal income reporting on your personal tax return.

Form 1065

Form 1065 is for partnerships to report taxes to the IRS. The business owners also need the K-2 or K-3 personal income tax form to go along with the Form 1065. This additional form will report what portion of the business profits are their personal share.

International Sellers

Foreign sellers can run stores on the Amazon US marketplace. They need to go through a tax interview first, though, before they can open an account. Every international seller also needs to turn in a Form W-8BEN before they can get approval. This form gives Amazon and the IRS the tax information of the foreign seller. This is what they submit in place of the 1099-K that US sellers use.

Navigating Your Amazon Seller Central for Tax Documents

As mentioned, you can see all your reports and tax documents in Seller Central. In case you aren’t finding where they all are, here’s a step-by-step example that we hope you will find useful:

First, make sure you’re logged into Seller Central. Then go to Reports and find the Tax Document Library. From there, locate the part where the Sales Tax Reports are.

From here, you can click the “Generate tax report” button. This will get you any tax report available in your account. You can choose to create a Sales Tax Calculation Report to remit sales tax. You can also generate a Marketplace Tax Collection Report to see what taxes Amazon will remit on your behalf. The Combined Sales Tax Report is also available for download. This report shows the sales tax that both you as the seller and Amazon will need to remit to the IRS.

Once you choose which report you want to create, you will see an “In progress” note. You can refresh it every few minutes until it shows as ready. Then you can download it and print it. The file will download as an Excel file. This file will have the complete data for each transaction made within the applicable time period.

Example

Let’s say you selected the Combined Sales Tax Report. Column X gives you the Total Tax. Column Y gives you the Total Tax Collected By Amazon. From these you can see the sales tax that:

- you as the seller need to report and remit to the IRS, and

- Amazon remits on your behalf, but you still need to report.

If Column X shows a non-zero number, you must generate a Sales Tax Calculation report. That’s where you can get the breakdown of the calculation by state, city, county, and district for every customer. This is important because taxes are different in different locations.

What Is EcomBalance?

EcomBalance is a monthly bookkeeping service specialized for eCommerce companies selling on Amazon, Shopify, Ebay, Etsy, WooCommerce, & other eCommerce channels.

We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month.

You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so you and your business partners can make better business decisions.

Interested in learning more? Schedule a call with our CEO, Nathan Hirsch.

And here’s some free resources:

- Monthly Finance Meeting Agenda

- 9 Steps to Master Your Ecommerce Bookkeeping Checklist

- The Ultimate Guide on Finding an Ecommerce Virtual Bookkeeping Service

- What Is a Profit and Loss Statement?

- How to Read & Interpret a Cash Flow Statement

- How to Read a Balance Sheet & Truly Understand It

Conclusion

Make sure you check with your state and city for local tax obligations and required Amazon seller tax documents. We highly recommend engaging a certified accountant with experience working with Amazon businesses. They will be able to give you the best advice on how to handle tax filing.