Amazon is one of the most prominent online selling/buying platforms. However, this platform presents some unique challenges for Amazon sellers regarding accounting, especially in terms of how Amazon presents tax information and sales numbers.

In this case, QuickBooks for Amazon sellers comes in handy. The QuickBooks Accounting Software simplifies and automates your accounting process by combining your transaction data into one easily accessible location.

While QuickBooks integration with Amazon simplifies some of the challenges of managing your financials as an Amazon seller, a few still remain.

In this article, we’ll share some tips of Quickbooks for Amazon Sellers, making it easier for them to manage their Amazon business finances.

1. Use Quickbooks Online for Amazon Sellers

Intuit’s QuickBooks Online (or QBO) is a cloud-based version of QuickBooks. While QuickBooks Online launched in 2004, Intuit has since made huge advancements with this product. Now it continuously boasts new features and offers services for small eCommerce businesses.

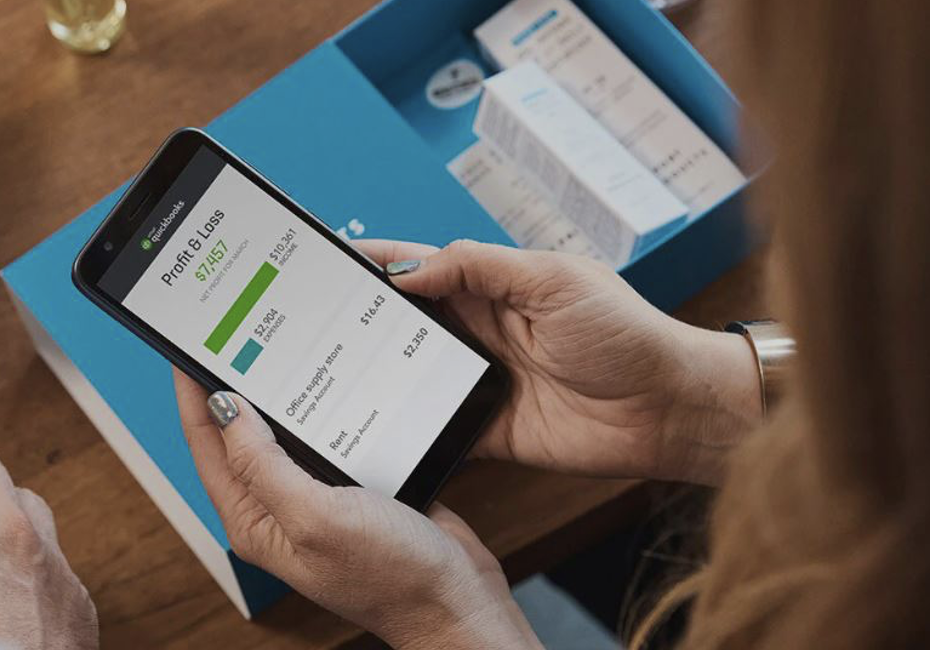

With it, you can create attractive invoices, pay your employees online, integrate hundreds of apps, and even do a lot of banking. QBO also proves quite easier to learn and use than QuickBooks Desktop. With QuickBooks Online, you can store and record data anywhere you have an Internet connection, and there are also mobile apps to help you manage your business on the go.

Furthermore, it allows contractors to access your account to do the work if you plan to outsource. Alternatively, your bookkeeper would need to work from your office. QBO makes Amazon bookkeeping easier without the need for large office spaces.

2. Use a Tool Like A2X or ConnectBooks

Tools like A2X or ConnectBooks provide seamless connectivity between QuickBooks and Amazon, resolving many of the issues caused by Amazon’s financial reporting.

Seller Central does offer the option to view lower-level information, but the data is very detailed and difficult to manipulate. These tools facilitate easy access to hundreds of lower-level transactions so you can understand where your money is going by bringing this information together in one place.

With these tools, you’ll be able to:

- Easily reconcile Amazon Pay payouts with original sales.

- Gain a better understanding of your financial data by breaking high-level transactions down to their lower levels.

- Easily view Amazon’s sales and expense data through QuickBooks.

- Upload settlement data automatically from Amazon whenever a new one is uploaded.

- Most importantly, reduce hours spent on bookkeeping to minutes by just reconciling.

3. Set Up Rules For Your Amazon Transactions

Amazon is a huge marketplace, and it’s easy to forget about the little things that can help you run your business more efficiently. When you sell on Amazon, it’s important to set up rules for your transactions. You can set up simple product-level or customer-level rules that will allow you to see when products are sold, which customers order them, and how much they spend on those orders.

It’s a great way to get an idea of what’s going on with your business. That will help you keep track of who bought what and when and ensure that you get paid for everything that’s sold promptly.

4. Set Your P and L Up So You Can See Amazon Sales, Fees, Refunds, Etc.

There are many different ways to get information about how well your sales are doing on Amazon; one of them is through a profit and loss statement (commonly referred to as a P&L). A P&L reflects exactly how much money you made from each item sold (also called a sale) and any fees or refunds you may have had to pay out during that period (which are called expenses). Keeping track of refunds, and fees that are deposited back into your account, as well as those that are not, is essential to keeping your books in order.

By setting up P and L on QuickBooks, you can determine whether your Amazon business has made profits or losses by comparing your income with your expenses. You can also see Amazon sales, fees, refunds, etc., once you have set up your P&L.

5. Hire a QuickBooks Expert to Run Your Monthly Books

QuickBooks is a powerful tool for managing your Amazon business. However, if you’re new to the program and haven’t taken the time to learn it properly, you might find yourself overwhelmed by the sheer volume of information available in the program—and that’s where EcomBalance comes in.

When you hire a QuickBooks expert like EcomBalance to run your monthly books, they’ll help you keep track of all of your financial transactions and tax information so that you can be sure that your company is running as efficiently as possible. They’ll also be able to walk you through any questions or issues you might have with the program so that you don’t have to spend hours trying to figure out why something isn’t working correctly.

Here are some tips for hiring a QuickBooks expert:

- Get a custom pricing quote from EcomBalance to see how much it will cost to have your monthly bookkeeping handled at a high level.

- Make sure they’re familiar with your accounts and know how they fit together to help you write accurate reports and keep up-to-date with any changes that may happen during the year.

6. Work With Your Bookkeeper to Manage Your COGS and Inventory Properly

If you’re an Amazon seller, you know that the way you sell can affect your bottom line. And if your business is like most, you’re probably trying to get more out of every sale by lowering prices and increasing the number of units in your inventory. But there’s a price to pay for that: higher COGS (cost of goods sold).

Your bookkeeper can help you manage these costs by helping you track inventory and pricing, which will help you make informed decisions about when to order more products or lower prices.

They’ll also be able to help you identify opportunities for cost savings through best practices like taking advantage of seasonal sales or seeking out promotions that can help offset common expenses like shipping or distribution costs.

Final Thoughts on Quickbooks for Amazon Businesses

For Amazon sellers, managing accounting processes and tracking transactions can be tricky, time-consuming, and nerve-wracking. Keeping your accounting books up-to-date is easier if you use QuickBooks.

You can record all income and expense-related transactions in QuickBooks, keeping inventory up-to-date and ensuring easy account reconciliation with the right tools. With the tips mentioned above, you can get the most out of Quickbooks for Amazon Sellers.

About EcomBalance

EcomBalance is a monthly bookkeeping service for eCommerce companies. EcomBalance handles your bookkeeping and sends you a Profit and Loss Statement, Balance Sheet, and Cash Flow Statement by the 15th of each month. EcomBalance also has a sister company, AccountsBalance, that caters to agencies, software companies, coaches, and other online companies.