For most business owners, taxes can be a real headache. But as the saying goes, nothing is certain but death and taxes. So if you are going to make it in the world of business, you’ll need to know all about calculating quarterly taxes (estimated). Fortunately, this isn’t as difficult as it may seem at first glance. In this blog post, we will walk you through three easy steps that will help you accurately calculate your estimated quarterly taxes so that you can stay compliant and on top of your tax obligations.

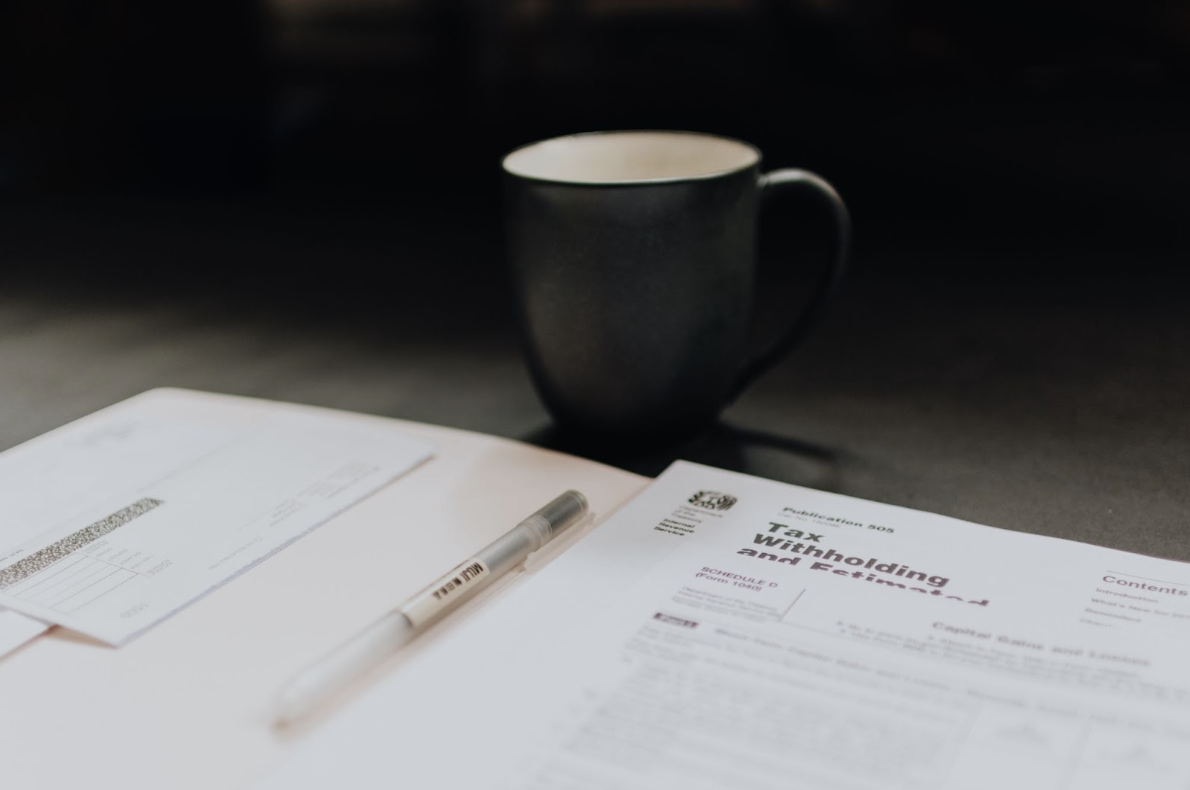

What Is Estimated Tax?

Business owners and freelancers are required to pay taxes directly to the IRS, rather than have them withheld from their paychecks. This form of payment is called ‘Estimated Taxes’ and must be made four times a year. Those who receive income in forms other than W-2 are responsible for making these payments.

What are quarterly taxes?

If you are self-employed or have any other income besides your regular wages, you are required to pay quarterly taxes. This includes money made from freelancing, tips, alimony, investments and gambling winnings. You will need to calculate your estimated quarterly tax liability and send in a payment for each quarter: April 15th, June 15th, September 15th and January 15th.

Calculating quarterly tax liability can be done two ways: using the IRS Form 1040-ES Estimated Tax for Individuals or the Short Method Worksheet in the Form 1040-ES instructions booklet. The short method is simpler and only requires that you know your total tax liability for the year (including any self-employment tax). To use the short method:

- Estimate your total tax liability for the year. This includes federal income tax, state income tax (if applicable), self-employment tax and any other taxes you may owe.

- divide this amount by 4 to get your estimated quarterly tax liability.

- Send in a payment for each quarter by the due date: April 15th, June 15th, September 15th and January 15th. If you do not pay enough throughout the year, you may be subject to penalties and interest charges.

How Do I Go About Calculating Quarterly Taxes?

If you are an employee, your employer generally withholds tax from your paycheck and sends it to the government on your behalf. If you are self-employed, or have income other than your salary, you may have to pay estimated taxes. Estimated taxes are used to pay both income tax and self-employment tax.

The IRS requires that you pay estimated taxes if you expect to owe $1,000 or more in taxes for the year. You must also pay estimated taxes if you expect that your withholding and refundable credits will be less than the smaller of:

1) 90% of the tax shown on your current year’s tax return

2) 100% of the tax shown on your prior year’s tax return (110% if AGI is over $150,000).

You calculate estimated taxes using Form 1040-ES. This form is available on the IRS website.

Who Pays Quarterly Tax Estimates?

If you are an employee, your employer is responsible for withholding the correct amount of taxes from your paycheck and remitting those funds to the government on your behalf. If you are self-employed, or earn income from sources other than a regular paycheck, you are responsible for making estimated tax payments throughout the year. You may have to pay estimated tax if you:

- Are in business for yourself (including as a freelancer, sole proprietor, partner, LLC member, or S corporation shareholder)

- Have income not subject to withholding

- Expect to owe tax of $1,000 or more when you file your return

- Had no tax liability last year

- Had a refund of less than $0 last year

If any of the above apply to you, read on for instructions on how to calculate and pay your quarterly estimated taxes.

How Do You Calculate It?

For calculating quarterly taxes (estimated), you will need to complete Form 1040-ES. This form is used to figure out and pay your estimated tax for the current tax year. When completing Form 1040-ES, you will need to estimate your income, taxes, deductions, and credits for the upcoming tax year.

You can use last year’s tax return as a guide in estimating your income, taxes, deductions, and credits for the upcoming tax year. However, be sure to take into account any changes that have occurred in your life since last year that could affect your taxes (e.g., change in job, marriage, the birth of a child). If you are unsure of how to estimate your income or any other information on Form 1040-ES, please consult a tax professional.

Once you have completed Form 1040-ES, you will need to calculate your estimated tax liability for the upcoming tax year. To do this, simply multiply your total estimated taxable income by the appropriate tax rate (e.g., if your taxable income is $50,000 and the tax rate is 25%, then your estimated tax liability would be $12,500).

After you have calculated your estimated tax liability, you will need to determine how much you need to pay each quarter. To do this, divide your total estimated tax liability by four (4). This amount is what you will need to pay each quarter in order to avoid underpayment penalties.

Step 1: Estimate taxable income for the year

If you’re an employee, your employer should withhold taxes from your paycheck and send them to the government on your behalf. If you’re self-employed, you’re responsible for paying your own taxes throughout the year. In either case, you’ll need to estimate your taxable income for the year in order to calculate your quarterly tax payments. To estimate your taxable income, start by adding up all of your sources of income, including:

- Wages, salaries, and tips

- Interest and dividends

- Business or freelance income

- Rental income

- Capital gains or losses

Then, subtract any deductions or credits that you anticipate claiming on your tax return. This could include items like student loan interest, alimony payments, or child care expenses. The resulting number is your estimated taxable income for the year.

Step 2: Calculate income tax

To calculate how much tax you owe, you will need to know your taxable income. This includes all forms of income, such as wages, salaries, tips, commissions, interest, and dividends. Once you have determined your taxable income, you can use the IRS Tax tables to determine how much tax you owe.

Step 3: Calculate self-employment tax

After you have calculated your federal and state income taxes, you will need to calculate your self-employment tax. This is a tax that is paid by self-employed individuals and is based on your net earnings from self-employment.

To calculate your self-employment tax, you will need to use Schedule SE (Form 1040), which can be found on the IRS website. On Schedule SE, you will enter your net earnings from self-employment, which is your total income from self-employment minus any deductions that you are entitled to take.

Once you have entered your net earnings, you will multiply this amount by 92.35% (or 0.9235). This calculation results in your taxable income from self-employment. You will then use the Tax Table found in the Instructions for Form 1040 to determine the amount of tax that you owe on this income.

Step 4: Add it all together, and divide by four.

If you’ve followed the steps above, you should now have a good idea of what your business earned and spent during the quarter. To calculate your estimated taxes, simply add up your total income and divide it by four. Then, subtract your total expenses from that number. The result is your estimated quarterly tax liability.

Of course, calculating your taxes is never quite that simple. There are a number of deductions and credits that can lower your tax bill. And if you have employees, you’ll need to withhold payroll taxes from their wages. But this method should give you a good starting point for estimating your quarterly taxes.

Is Paying Quarterly Taxes Necessary?

While paying quarterly taxes is not required, it may be necessary depending on the amount of tax you owe. If you expect to owe $1,000 or more in taxes for the year, you should make estimated tax payments. Estimated tax payments are made throughout the year to cover your tax liability. This means that if you do not pay enough tax throughout the year, you may be subject to a penalty.

When Do I Pay Estimated Taxes?

If you are self-employed or have any other income that is not subject to withholding, you are responsible for paying estimated taxes. Estimated taxes are paid in quarterly installments, and each payment is due on the 15th day of the month following the end of the quarter. For example, if you earn income in January, February, and March, your first estimated tax payment would be due on April 15th.

If you don’t pay enough tax throughout the year, you may be subject to a penalty. The best way to avoid this penalty is to make sure that you pay at least 90% of the tax that you owe for the current year or 100% of the tax that you owed for the previous year (whichever is lower).

If you’re unsure how much-estimated tax you should pay each quarter, you can use the IRS’s Estimated Tax Worksheet to help calculate your payments.

Conclusion

Calculating your quarterly taxes (estimated) can be a complicated process, but with the right knowledge and steps, it doesn’t have to be. We hope that this article has given you some insight into calculating quarterly taxes and make sure that you are paying the correct amount. By following these three steps, you can stay compliant with federal regulations while also minimizing the tax burden on yourself or your business. Good luck!