When you’re choosing between EcomBalance and Pilot bookkeeping services, it’s important to keep a few things in mind. First, the process of the two companies is similar. You have to look into the details to find which one will suit you best.

What core services does EcomBalance offer?

EcomBalance offers monthly bookkeeping as its primary service. This is targeted at small to medium business owners in the eCommerce space.

Do you run an eCommerce business selling on online marketplaces like Amazon, eBay, Walmart, Etsy, Shopify, and the like? Are you looking for a bookkeeping service that handles your books and understands the ever-changing space of online selling? Look no further, because EcomBalance was made first and foremost with you in mind.

Let’s zoom into the finer details of this service and what you can expect.

- Accurate and on-time monthly reports – Your books are vetted by 2 levels of bookkeepers multiple times each month. This is to ensure the contents are pinpoint accurate. You can get these reports on or before the 15th of each month. These deliverables include Profit and Loss Statements, Balance Sheets, and Cash Flow Statements.

- Monthly analysis – Get help understanding your numbers so you can make better financial business moves going forward. They make sure that reports are easy to understand and readable regardless of your level of financial know-how. They also go over key findings of the month.

- Insights – They also provide their knowledge and experience to guide you in your financial strategy and decision-making. They can show you the areas where you can lower costs and areas that have more money-making potential.

- Expertise – Bookkeepers and accountants hired by EcomBalance are well-vetted and are experts in the eCommerce space.

- Tried and tested processes that work – Through reliable and scalable processes, they will make sure to maintain your books in tip-top shape.

- Support team at the ready – Have a question? Need to voice out a concern? EcomBalance has multiple channels of communication to contact your team. You can send them an email and they will reply within 1 business day. You can also text your team and even schedule calls.

- Dedicated bookkeeping team – You have your own Head of Bookkeeping and a Bookkeeping Assistant whom you can work with closely. They can also answer any financial queries you may have.

What You Get with EcomBalance Bookkeeping

Let’s walk through what the process would look like if you decide to sign up for EcomBalance bookkeeping services:

- Create an account.

- Schedule a Kickoff Call. Here you will meet with an EcomBalance member(s) and familiarize them with your business.

- Receive a custom pricing quote. After their bookkeepers go over your books, they will send you a personalized pricing quotation. This differs with each business as they take time to evaluate each business’s needs accordingly.

- Work with your dedicated team to connect all accounts and channels.

- Your bookkeeping team will manage your books and keep you updated on anything out of the ordinary.

- Receive monthly financial reports and analysis, and advice.

EcomBalance strives for solid, long-term, close, working relationships and strong, stable communication with clients. With EcomBalance you aren’t just contracting a job, you are forming a partnership.

What core services does Pilot offer?

Pilot has three main offerings: monthly bookkeeping, CFO services, and tax services. Let’s look at their bookkeeping services.

Pilot’s primary service is monthly bookkeeping optimized for growing businesses. They exist so that businesses can be free from the tedious, time-consuming, and often stressful tasks associated with tracking and managing their finances. Instead, they want businesses to focus on other areas of growth and progress and leave the books to them. They will track your profits and expenses, reconcile all your accounts, and you will receive errorless, comprehensive financial reports to inform your next business move. It’s a win-win.

What You Get with Pilot Bookkeeping

- Accurate books by an expert team aided by great Bookkeeping software.

- A dedicated finance expert that can provide valuable insight and suggestions. It’s more than just bookkeeping, it’s a partnership.

- Tax and CFO services. (We will expand on this in the following sections of this article.)

So, what does the Pilot process look like? Well, it’s simple.

First, you schedule a meeting with a dedicated bookkeeping expert who will help guide you throughout the whole thing. They’ll assist you with onboarding and get familiarized with the way your business works. With Pilot, you are getting a partner that will stick with you as your business expands.

Second, Pilot’s finance expert will collect your transactions. This process is hassle-free because Pilot integrates with the tools you were already using before, such as QuickBooks or Gusto.

Third, after they reliably and accurately input all your monthly financial data, they will deliver detailed financial reports. (profit and loss, balance sheet, and cash flow statement). These reports also include valuable custom metrics depending on the business, burn rate for beginners, and inventory updates for eCommerce businesses.

Lastly, you can also add on some of their other offerings such as CFO or tax services if needed.

Does EcomBalance or Pilot offer tax services?

EcomBalance

EcomBalance offers an add-on service if you want to hand off your sales tax. As early as you sign up, make sure to mention that this is a service you are interested in and we will be happy to discuss it in detail with you.

Aside from sales tax, EcomBalance does not currently offer any other tax prep, tax filing, or other income tax services. However, if you are interested, EcomBalance has a network of vetted, trusted, CPAs we can connect you to. We can attest that these accountants are skilled experts that have worked with several other eCommerce businesses. Because our bookkeeping documents are delivered tax-ready, it will be an easy transition to your accountant.

Even if you opt for an accountant outside our network, we at EcomBalance will make sure to maintain the strong communication we are known for. We want to make your life easy, and so we will provide whatever your accountant may need for tax purposes, saving them time and effort, which subsequently could lead to lower costs for you.

Pilot

Pilot offers custom-fit full-service tax preparation and filing. Alongside your finance expert, Pilot will also provide you with a dedicated tax preparer. This expert will get all your filings done so you won’t have to worry about it. You’ll be able to stay updated and check progress on your tax prep and filing at any time.

Additionally, Pilot offers a service specific to US companies that have research and development costs. This is called R&D Tax Credit and if your business is qualified and IRS-approved, you can claim a sizable credit amounting in the hundreds of thousands. Pilot will make sure that this process is done properly. Furthermore, they will make sure that all the documentation for the tax claim is complete. So, you will get to collect the maximum benefits possible.

What software does EcomBalance and Pilot use with their clients?

EcomBalance uses Quickbooks Online, Xero, and A2X.

Pilot partners with tools such as Quickbooks Online, Gusto, Bill.com, and Square.

What is the pricing for EcomBalance and Pilot?

EcomBalance

All clients receive a custom Pricing Quote from EcomBalance. It’s easy to submit a quick 5 minute form and receive a custom pricing quote within 1 business day.

Simply sign up, enter your information, send View Only access to your Quickbooks Online or Xero account and they’ll get you a price quickly.

All EcomBalance Prices include 2 things:

- Catch Up and Clean Up Work: If you need any of your months caught up or cleaned up, they’ll include a one time price for that.

- Monthly Bookkeeping: You’ll then also get a monthly price for having EcomBalance handle your monthly bookkeeping.

Their pricing depends on a number of factors:

- Transaction volume

- Number of accounts (banks, marketplaces, processors)

- Size of the business in yearly revenue

- Complexity of the books

- Any add on services

Sign up to get a more specific pricing quote.

Pilot

2 bookkeeping plans:

1. Bookkeeping Core Plan

$599/mo billed annually

$15,000 in monthly expenses

- Dedicated finance expert

- Accrual basis bookkeeping

- P&L, balance sheet, and cash flow statements

- World class support and advice

2. Bookkeeping Select Plan

$849/mo billed annually

$15,000 in monthly expenses

- All Core offerings

- Industry standard financial ratios

- Expedited books delivery

- Monthly phone reviews

- Priority support

If you need more, you can check out their custom Plus pricing

3 CFO Services plans:

1. Monthly Engagement Plan

$1,350/mo billed annually

- 3hours of CFO engagement

- Monthly updates and financial forecasts

2. Annual Budgeting & Forecasting Plan

$8,100/year

- Personal CFO Consultations

- Revenue projections

- Various budgets

- Forecast drivers based on historical trends, financial ratios, or custom inputs

- Sensitivity analysis

- Scenario planning

- Robust three statement models

3. Tax Essentials Plan (for startups)

$2,450/yr

- Support for unprofitable C corps

- Federal corporate income tax filing

- State corporate income tax filing

- Delaware Franchise tax filing

- 1099-NEC filing

- Email support

- Free tax extension

If you need more, you can check out their custom Standard pricing

Who is EcomBalance built for?

Having had experience as successful million-dollar sellers on Amazon, the founders of Ecombalance, Nathan Hirsch and Connor Gillivan recognized the need for a simple, yet reliable bookkeeping service aimed at eCommerce professionals. Their goal is to revolutionize how they can offer bookkeeping to these eCommerce businesses.

Who is Pilot best for?

Pilot is for growing businesses and startups. They have the best finance stack for this tier, and have startup expertise as well. As a startup itself, Pilot founders created the service for VC–backed companies.

What are the reviews online for EcomBalance and Pilot?

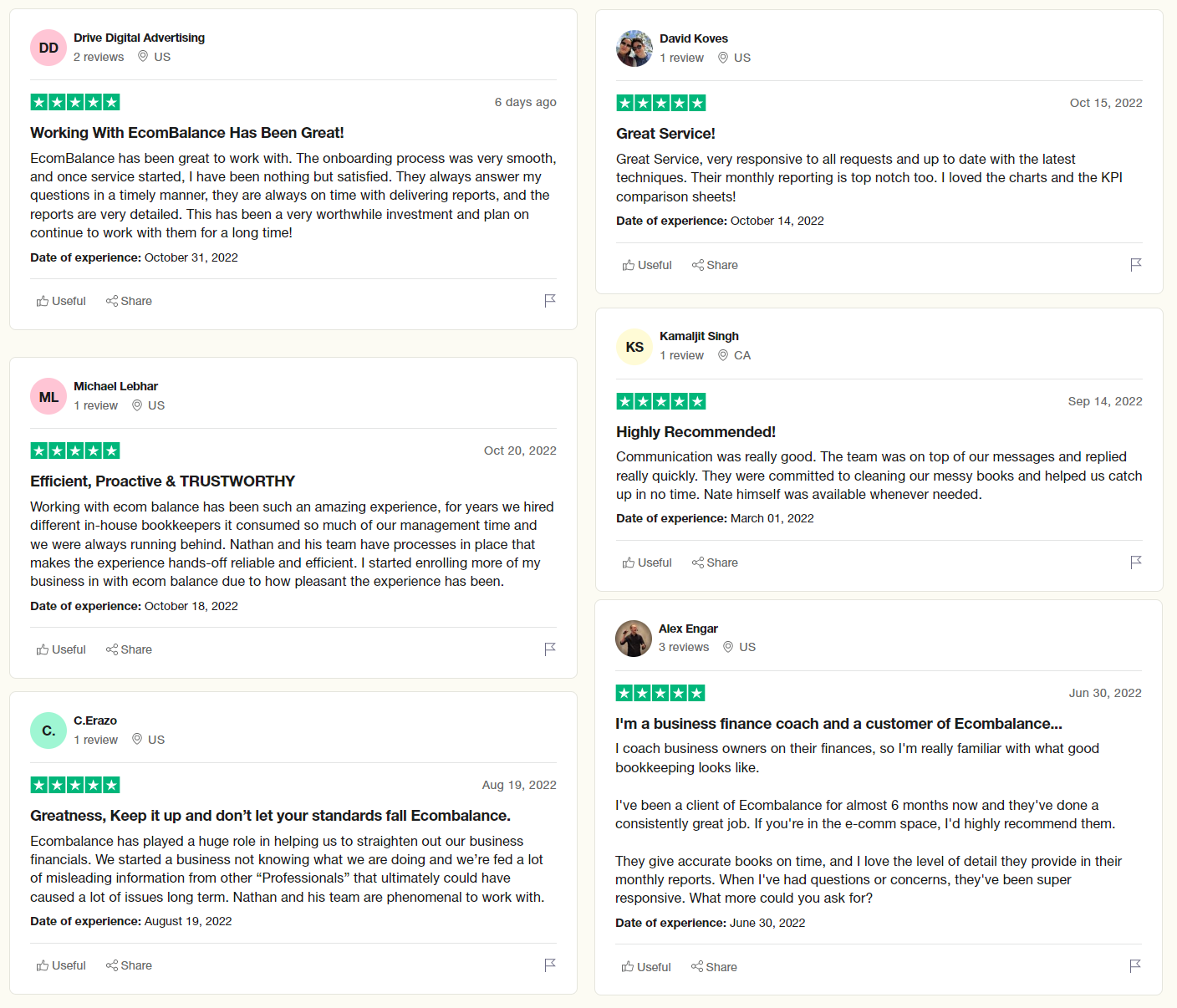

EcomBalance Reviews

4.6 / 5 stars

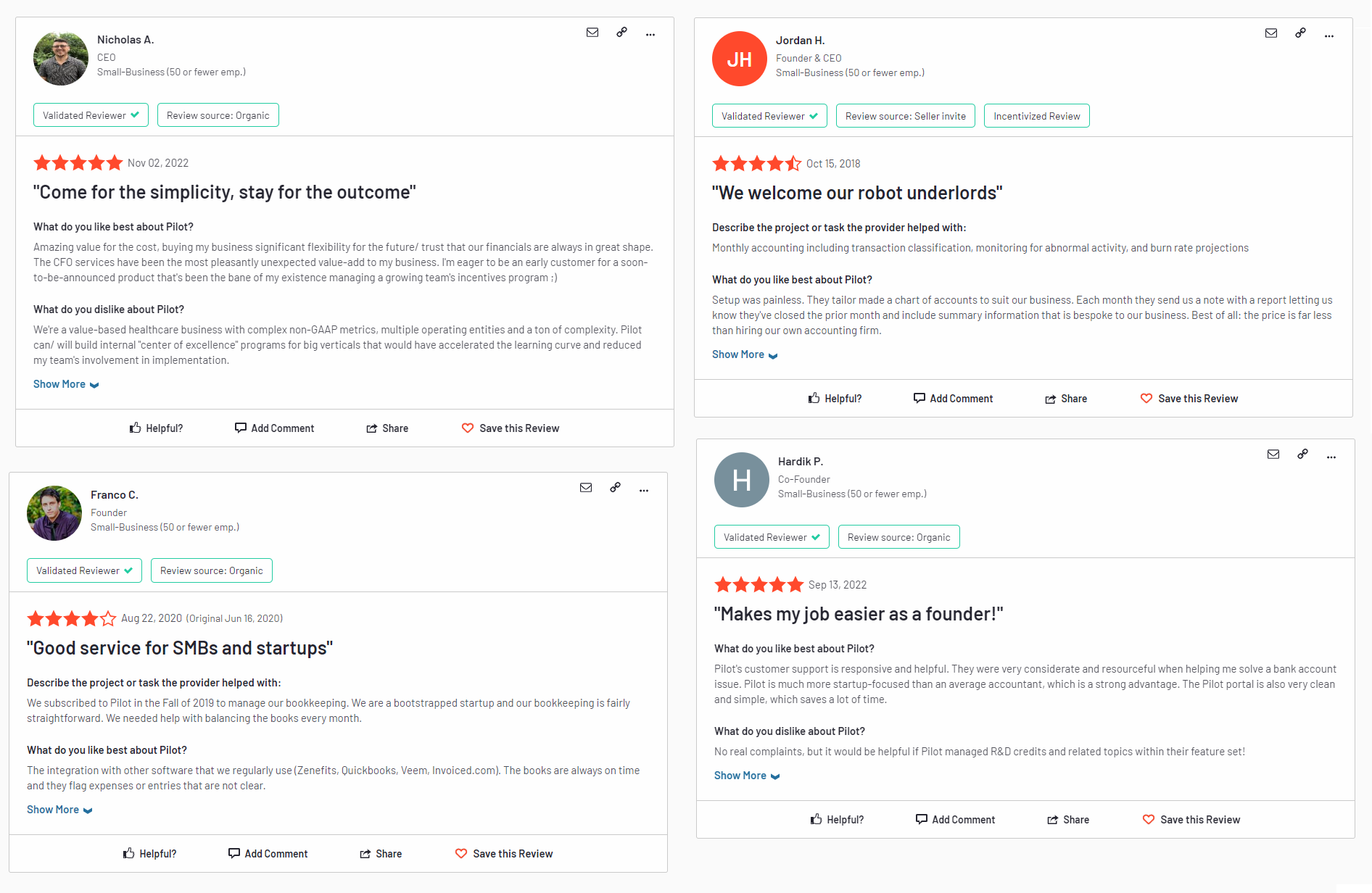

Pilot Reviews

4.5 / 5 stars

Conclusion

EcomBalance and Pilot are both startups that offer highly-rated bookkeeping services. EcomBalance focuses primarily on affordable yet quality bookkeeping while Pilot bookkeeping is accompanied by two other core services, namely CFO services and tax services. It’s a close match between them! We recommend looking deeper into their content and customer reviews to see which one appeals to you more.