Money. Every business worries about it.

And ecommerce businesses are no different. You’ll stress about what cash is coming in, what expenses are going out and when you’ll need a little extra capital to fund growth efforts.

Most of your money problems can be solved by bookkeeping tools dedicated to e-commerce businesses like EcomBalance but when it comes to actually funding your ecommerce store, there is a mountain of decisions and considerations for you to make on your own.

Or so you thought.

With this article, the journey to sourcing growth capital has gotten a lot easier and a lot less lonely.

Below you’ll find the 5 things you need to know when choosing the funding option that will set your ecommerce business up for success and how finance providers like Uncapped are best positioned to help.

1. You have a lot of options

Ecommerce funding is an umbrella term covering all finance options available to ecommerce businesses.

Your mind might first turn to more traditional options such as bank loans, business credit lines, or even investors. They represent well trodden paths to financing that have been used across industry types.

But funding options are growing every year and businesses have more options than ever before.

Some of the newer options are proving to be quicker to secure, more flexible with repayment terms and designed with certain industries—like ecommerce—in mind.

Let’s look more closely at the pros and cons of both traditional financing options and newer, industry-focused ones such as revenue-based financing.

Traditional financing options vs. industry-focussed alternatives

Often, people do what’s always been done because they feel secure in knowing the outcomes. They’ll do so even when a better option exists.

That’s why so many business leaders still turn to bank loans when sourcing funding.

While bank loans have low interest rates and are relatively low risk, the process to secure them is lengthy and requires a lot of paperwork.

The alternative funding market offers a variety of lending solutions, from flexible revenue-based financing to simple and transparent fixed-term loans. This means you can select the funding option that addresses the needs of your business. You can also switch between the different repayment models as your company scales and your needs change.

At the end of the day, both tradition and alternative options come with their unique pros and cons.

Traditional Financing (i.e. bank loans)

Pros

- Low interest rates

- Banks won’t call in your loan unless you stop making repayments, meaning no nasty surprises

- You can spend the money as you like

Cons

- Slow, cumbersome application process

- Requires a business plan and other paperwork

- Can require a personal guarantee against the loan

- Strict repayment terms

Alternative Ecommerce Funding (i.e. revenue-based financing, inventory financing, fixed-term loans)

Pros

- Freedom to choose the repayment model that best suits your business ● It’s easy to apply to and can be done online with little to no paperwork. The lender just needs to see your sales history.

- Approval and access to funds is fast and seamless

- You maintain complete control of your business — no loss of equity

Cons

- If you have unreliable revenue or have yet to make revenue, your odds of qualifying are small

- Loan amounts are determined by your MRR so you could be limited in how much you borrow

- Best for short-term financing and spend that generates a good ROI

2. Qualification requirements vary by provider

Some ecommerce funding providers’ qualification processes are short, quick and easy while others invent hoops for you to jump through before you can ever set eyes on the cash.

Trends and opportunities come quickly in ecommerce and to make the most of them, you need a funding option that moves just as fast.

Revenue-based financing from Uncapped can be approved in one day because they only need access to information about your financial history, not a detailed business plan.

This means you can almost immediately pay for that exciting new marketing campaign, restock inventory that’s in high-demand, or relieve the mounting pressure on your cash-flow.

Uncapped also provides inventory financing and fixed-term loans. The application process is a short online form that takes only minutes.

If you have a lot of time to build a business case and wait for approval, you can still consider financing options such as investment, a good old fashioned business loan or a business line of credit.

3. Some types of ecommerce funding will restrict how you spend the capital

Some funding providers limit the things you can do with the money they’ve provided so you’ll need to understand the restrictions in place and make sure they’re in line with your business goals.

The types of funding options that restrict how you spend your funding are: Marketplace financing

Ecommerce marketplaces such as Shopify and Amazon double as loan providers for stores who exist within their marketplace. However, some require their funding to be spent exclusively on your store within the marketplace.

So for businesses who have digital storefronts outside of the marketplace or who have plans to one day, this isn’t your best option.

Inventory loans

It’s all in the name—these loans are designed to fund the purchase of one thing and one thing only: inventory.

They’re not the same as inventory financing, which is when inventory is used as security in exchange for growth capital that you can spend without restriction.

Inventory loans are great for a business who needs to buy stock in bulk but if you have the idea of spending that money elsewhere, think again.

Inventory lines of credit

Inventory lines of credit have the same restrictions as inventory loans. The only real difference is that they function as a line of credit, so you can take out further funding when you need to restock your inventory supply.

Financing options that offer flexible spending

Lucky for you, you don’t need to be held back when taking out ecommerce funding— there are plenty of flexible alternatives to marketplace financing, inventory loans and lines of credit.

You can consider:

- Inventory financing

- Revenue-based financing

- Fixed- term loans from bank alternatives

- Traditional bank loans

- Merchant-cash advances (careful! They can come with high APR)

4. Repayment can be flexible with the right provider

A lot of hesitancy and fear around taking on funding is that it comes with the expectation of repayment. But not all repayment terms are frightening.

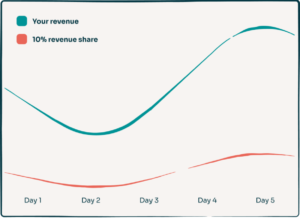

Revenue-based financing, for example, has repayment linked to how much revenue you bring in every day, week or month.

That means you’ll never pay more than you can afford, and payments will fluctuate. So, if your business experiences highs and lows, you’ll sleep easy knowing you won’t be out of pocket just because you’ve taken on funding.

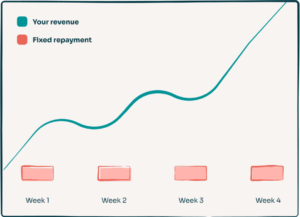

Some businesses prefer to have fixed repayment because they can plan cash-flow accordingly. For this reason, Uncapped introduced fixed-term loans. Businesses who take on a fixed-term loan will know the exact amount they owe every month and when it will be fully repaid.

5. Your business needs determine which option is best for you

If it isn’t evident already, there are several factors which can make a funding option a good or bad idea. And what makes them a good or bad idea for you is completely dependent on the needs of your ecommerce business.

So, what are the needs of your business?

Growth

A lot of ecommerce businesses want to fund growth activities within marketing and advertising but the costs of those initiatives add up quickly. If that’s the case, you may need a funding option that you can seek further funding from.

Financing providers like Uncapped are able to offer multiple rounds of funding for ecommerce businesses. It’s a good option if you’re in a stage of growth and want to capitalize on opportunity.

Flexibility

Another key concern and need for ecommerce businesses is repayment that can align to their high and low seasons.

As mentioned before, revenue-based financing both fluctuates with how much revenue you’re bringing in. Its flexibility you wont get from other providers such as traditional banks.

Don’t forget that flexibility extends beyond repayment and into use of the funds. Marketplace financing through platforms like Amazon will significantly limit your spending by requiring you to only spend within the platform itself.

Many ecommerce sellers have ambitions beyond a single marketplace and will want to use their funds at their own discretion. If that sounds like you, then inventory financing through Uncapped is your best bet.

Fast-access

Things move quickly in ecommerce businesses. Demand can spike overnight, social media trends can require fast action and if something goes wrong with your inventory, you’ll need to restock it as soon as possible.

So not everyone has the luxury of waiting around for access to capital. If that’s you, you’ll need a funding provider that can get you funds as soon as possible while still doing their due diligence.

In this case, it’s good to have a finance provider who can approve your application in as little as 24 hours.

Industry support

When a large sum of cash lands in your lap, it might be helpful to get advice on what to do with it.

Finance providers like Uncapped offer borrowers access to a network of experts in the ecommerce industry so that they can spend the capital with confidence. They can get advice on marketing, hiring, and scaling in general in addition to any number of topics that experienced investment managers will have insights on.

The best part is that these experts manage a portfolio of brands who have already successfully scaled their stores with Uncapped funding. It really is getting the help of people who have ‘been there, done that’.

Your next steps

You now know the 5 key considerations you should make when selecting an ecommerce funding provider.

But we understand that it’s a big decision and you may want to do a little more research before committing.

One of the best things you can do is find out how other ecommerce businesses have funded their business to success. Check out how a pet subscription brand PsiBufetused used their funding from Uncapped to acquire more customers and become a market leader.

If you do feel ready to move forward with a funding option, you can fill out this form and be 24 hours away from up to $10million.