Written by Stefania Pilindavic, Director of Client Services, BellaVix

With Amazon being the world’s biggest eCommerce platform, it doesn’t come as a surprise that many people want a piece of the cake for themselves. There are so many success stories of people who turned their small passive incomes into thriving, several figure businesses as Amazon Sellers.

We know that it takes a lot of time, effort, and, most importantly, financial investment to make your Amazon store successful. When creating a business plan for launching products on Amazon, most sellers usually only consider the typical or most apparent costs required. These Amazon FBA fees include (provided that the sellers are selling FBA):

- Manufacturing/product cost

- Packaging cost

- Shipping cost

- Subscription fees

- Amazon FBA fees

- Referral fees

- Storage fees

- Advertising/marketing investment

There are a couple of additional Amazon FBA fees, such as Removal/Disposal or Refund Administration and High Volume Listing fees. These only apply if you’re using these services.

And in a perfect world, once Amazon determined the charges for you, you would have a ‘clean’ payment report, and all the numbers would reconcile perfectly. However, most sellers know that this is not the case. We will show you a couple of checks you should perform each month to avoid additional financial losses.

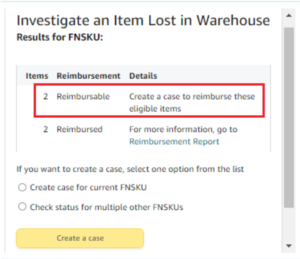

Lost/Damaged Inventory

Lost and Damaged Inventory happens more often than it should. Still, Amazon sometimes forgets to issue reimbursement to sellers for the items they have lost or damaged at their warehouse. It may not seem like a great deal, but when you look at the totals, item by item, the sum adds up, and it’s not insignificant.

You should be checking the Lost and Damaged Inventory every month.

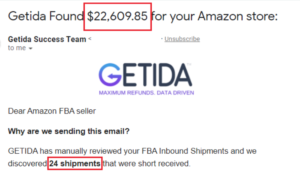

Unreconciled Shipments

Shipment reconciliation is another significant step that often gets overlooked by sellers. You should check your shipments once a week to ensure that Amazon received all the products you sent. You can reconcile shipments for the last nine months, so if this is something you haven’t been checking, there might be a chunk of money coming your way!

Customer Returns

Often, a purchase has been finalized, but is then returned by the customer. We know Amazon is very customer-centric, so the customers get their refunds or replacements immediately, but what happens with the sellers in this case? Either the seller is reimbursed, or the product is returned to the sellable inventory pool (with a few exceptions). However, as simple as it may sound, two things can also go wrong in this process:

- The product is never returned

- The seller is not reimbursed

Checking this can be rather time-consuming, and it involves downloading and cross-referencing several reports such as Payment Reports (Transaction View: Refunds), FBA Customer Returns, and Reimbursements Reports by using several different formulas, which will ultimately give a clear overview. You need to have an easy way to check what happened to the return: were you reimbursed, or was the product returned?

By creating the report using various Excel formulas, you can clearly see whether you have received an appropriate action from Amazon. Either you have been reimbursed, or the product has been returned to you, or both. If this is the case, all is good, and there is nothing to worry about.

However, if neither action has been taken, you should open a case, investigate what happened with the customer return, and have Amazon reimburse your loss.

Just remember that customers have 45 days to return the product, so you should not look at the last 45 days.

Amazon FBA Fees

The dimensions of your products determine Amazon FBA fees. However, sellers need to pay bigger attention to this for 2 reasons:

- Are you being charged the correct fee?

It’s not unusual for Amazon to charge incorrect fees. You should keep a close eye on these because they are using a machine to measure your products, and machines are not flawless. If you notice a discrepancy, open cases providing proof via images to have the fee changed and to get reimbursed for the orders that have had incorrect charges. Obviously, the higher the difference in fees and the sales volume, the more money you have left on the table!

It is recommended to do this every quarter because you can only be reimbursed for the past 90 days.

- Are your FBA charges consistent?

This also happens more often than it should. As a seller, you see the FBA fee charged by Amazon in your Manage Inventory or Fee Preview reports, you did your own math, and the fee matches, but is Amazon really charging you that amount?

Even though you can get reimbursements for the past 90 days, this check should be done monthly, especially if you deal with a large catalog or have a very high sales volume.

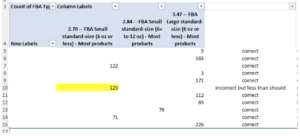

The process requires downloading Date Range Reports, reviewing the actual FBA charges, and using pivot tables to have a clear overview.

The end result may look something like this (if you’re lucky!):

This shows us that Amazon is being consistent with its charges. All orders show the same FBA fee. Keep in mind that this report does not tell you whether the fee is correct or not. This only shows us if Amazon is consistent or not! In one example here, we can see that one product has 125 orders in the period, and Amazon charged them all the same fee of $2.70. However, the fee is not correct. But it is the same for all orders in a given period.

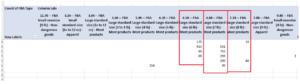

OR, like this:

We can see in the above example that one SKU has different Amazon FBA fees and charges in a given timeframe. For instance, one SKU (the last one on the list) has been charged $5.98 for 214 orders and $6.88 for 99 orders. Assuming that the lower fee is correct (refer to the previous step of this section), this seller paid $89.10 more than they should to Amazon. Now, this may not seem like a lot, but when you look at the difference in fees, multiply that with the number of incorrect orders, and do the same for several SKUs, that’s a lot of money to just give away.

In Conclusion

So, there you have it! There are quite a few places where you could be losing money and suffering financial loss without even realizing it. Making sure everything is checked and accounted for can be rather time consuming and involves some Excel skills. Tools like Getida can help you identify and recover these, and we, at BellaVix, are thrilled to use this tool. Not only does it save and recover our clients’ money, but it saves our time as well, which ultimately is the most expensive resource today! Get in touch with the BellaVix team to navigate your way to growth and success on Amazon!

*SKUs and seller information has been hidden to protect the privacy of the sellers