Financial management can be tedious, and this is why Amazon accounting services exist. For some eCommerce business owners, it can be difficult to accomplish without this expert help.

Below is a list of some of the best eCommerce accounting services that help Amazon online sellers. These services assist businesses with understanding their finances and improving their processes. This allows them to focus their attention on other aspects of the business and enables them to achieve greater success through wise decision-making.

1. Seller Accountant

Seller Accountant offers accounting experts specifically for eCommerce sellers. They help take the stress away so that you can focus on achieving greater profits.

Seller Accountant understands that operating an online business can be difficult – the financial management aspect being no exception. Through their professional bookkeeping and accounting services, they hope to assist businesses in growing into the best that they can be.

There are a lot of online sellers who are not proactive when it comes to bookkeeping and financial management. Oftentimes, they end up having to run damage control for issues that could have been avoided easily . This is where Amazon accounting services like Seller Accountant come in. By taking care of all the laborious accounting work, they free up resources to invest in other areas of the business. The team also helps to identify potential problem areas before they get out of hand. If you like, these experts can even provide you with valuable insights on eCommerce trends to get your business to where you want to go.

The programs they offer include bookkeeping, Amazon accounting, CFO (Chief Financial Officer) coaching, and DIY courses.

2. Seller CPA

The team at Seller CPA is knowledgeable about Amazon, online selling, and the needs of sellers. They cater specifically to Amazon sellers and support multi-channel selling. They are a one-stop shop for monthly bookkeeping needs, handling federal and income tax returns, and also offer consultation for any bookkeeping concerns. CPAs (certified public accountants) either supervise all their services or perform the services themselves. This means that they can assure businesses of the accuracy, quality, and legitimacy of their offerings. They do not outsource the Amazon accounting services that they provide. They do not hire from foreign countries, either. Note that this can increase costs dramatically.

Not all CPAs understand selling on Amazon, and that is the gap that Seller CPA fills. Their founder, Steven Freshour, is a CPA who noticed there was a need for accurate information on bookkeeping, sales tax, and income tax in the online selling space. As an Amazon seller himself, he also understood the challenges and the changes that occur on the platform. So, he decided to create a firm that solely focuses its efforts on helping Amazon sellers with their financial needs.

Both businesses who are just getting off the launchpad and businesses who are looking for a firm that is knowledgeable about Amazon selling can rely on Seller CPA to provide accurate bookkeeping, thorough tax preparation, and clear answers to their financial queries.

3. Ebiz Accounting

Ebiz Accounting is another service dedicated to assisting Amazon sellers. Their experienced team has the financial expertise to provide sellers with services that can help them be more effective on the popular Amazon Marketplace.

With more than 10 years of experience dealing with Amazon businesses, they are more than capable of taking care of your financial needs. Whether you need bookkeeping, sales tax computations, tax preparation, or other financial work, their Amazon accounting services will get the job done. Their quality services are cost-effective and personalized to each client. This customization is one of the best things about Ebiz Accounting. The services they offer include Amazon Business Formation, Amazon Seller Bookkeeping, Amazon Seller Financials, Amazon Seller Sales Tax, Tax Return Preparation, and general financial advice and guidance.

4. Fully Accountable

Fully Accountable is an accounting firm of US based CPAs and eCommerce experts. They provide eCommerce and tech businesses with outsourced Amazon accounting services. These services include covering tasks mainly in the areas of finance, accounting, and fractional CFO services. They help businesses streamline the accounting process. They also make sure that these businesses have the tools and information they need to make the best decisions and be as profitable as can be.

Their bookkeeping services give businesses access to:

- Key insights for business growth and increased profitability

- Daily processed transactions, which is just like having your own internal accounting firm

- An assigned expert who will provide valuable advice gleaned from financial reports, such as locating potential problem areas and offering solutions

Their other offerings include corporate services, end-of-year tax planning, and mergers and acquisitions.

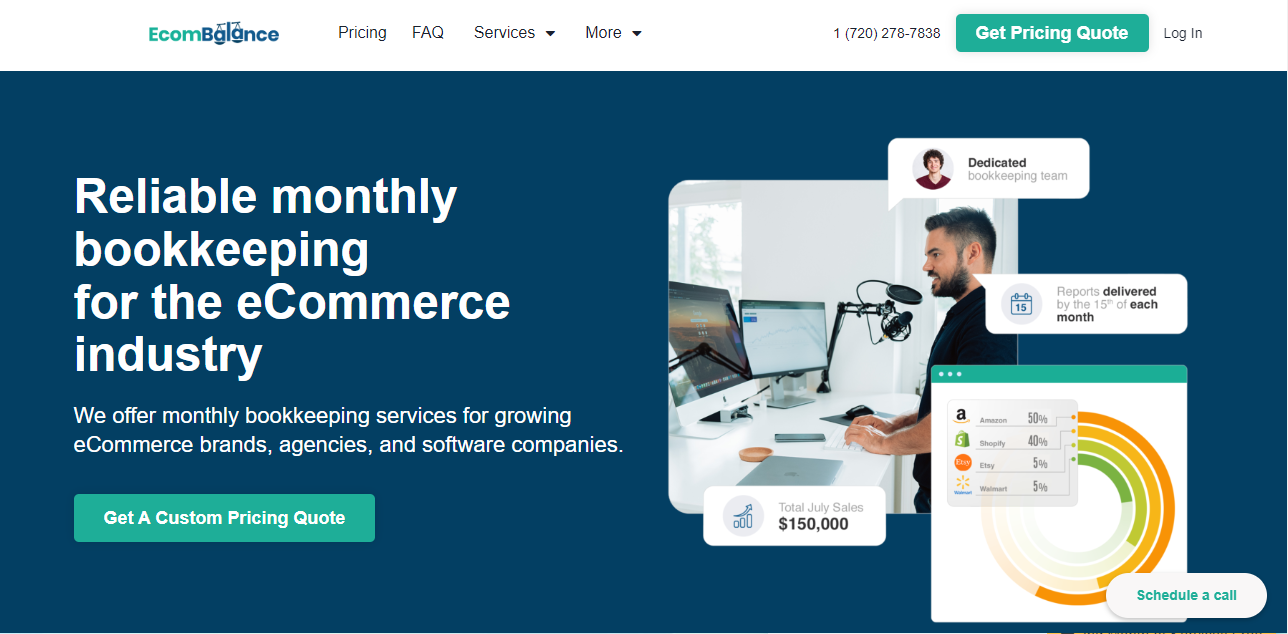

5. EcomBalance

EcomBalance offers monthly bookkeeping and accounting services for brands, agencies, freelancers, content creators, and software companies in the eCommerce industry. Whatever the platform, be it Amazon, Ebay, Etsy, etc., Ecombalance is committed to helping businesses with financial management. Their bookkeepers specialize in eCommerce, specifically Amazon accounting services. They always make it a point to learn about the businesses they work with to provide a catered service.

They are a good choice because they are experts in the eCommerce space. Their process is simple, reliable, and easy to build on. Their eCommerce bookkeeping team actively communicates with businesses. They analyze reports and give insights and feedback to improve financial operations and profitability. They are also keen to be able to proactively get ahead of potential problem areas. This not only makes businesses better informed about their financial status but also enables them to make better decisions.

6. AMZ Accountant

AMZ Accountant offers eCommerce sellers on Amazon and Shopify full-service financial management solutions including accounting, bookkeeping, payroll services and tax planning and preparation. They handle the challenging and tedious financial tasks so business owners don’t have to. Their goal is to help businesses increase their profitability.

Their virtual CFOs are flexible in the roles they perform. Depending on your business needs, they can take on the responsibilities of accounting, bookkeeping, planning and preparing tax papers or providing guidance and business advice. This versatility means paying only for the services required. They even offer a complimentary meeting to discuss these requirements before hiring them on.

If there’s one thing they specialize in, it’s helping businesses be as tax efficient as possible. They are all about making sure businesses don’t overpay for taxes, get the most tax deductions possible, and reduce their tax liabilities.

Their cloud bookkeeping is detailed, accurate, and allows for real time updates. They will even analyze key financial metrics under cash management and profit management. This will show you a more accurate picture of your business’s financial health so you can make better business decisions. Their tax strategies are tailored to eCommerce businesses that traditional accounting firms may lack.

Tax Planning and Preparation

AMZ Accountant incorporates effective tax planning into your tax process. They offer virtual tax preparation as part of their Amazon accounting services. This also works for other eCommerce businesses like Shopify stores. This is not meant to reduce taxes, but covers compiling information, preparing tax forms, and filing documents.

AMZ emphasizes the importance of effective tax planning. Their virtual services involve proactive tax planning to help clients reduce how much they pay in taxes. This is so that they can help businesses to save more money on their tax returns. Their legal methods are transparent, error-free, and up-to-date. This is always a great place to start with any accounting service.

7. Ampersand Accounting

Ampersand Accounting is a firm that offers full-service accounting that includes some automation processes and sales tax solutions. Their focus is on eCommerce businesses in the US. Their team is extremely competent in income tax, sales tax, and tax technology. They are transparent and inform businesses about the how and why of their processes. They always make sure of this so that businesses are not left in the dark.

Their primary focus is offering tax management solutions and helping businesses in the eCommerce industry comply with tax laws and regulations. Because they have experience selling on all kinds of eCommerce platforms, including Amazon, Shopify, Etsy, and eBay, their team can provide valuable insights to businesses and help propel them forward and increase their profitability wherever they sell. Their team also provides support via phone or email for quick communication and assistance.

Ampersand Accounting has tax experts that can educate businesses on tax liability. These experts can also assist in ensuring that a business remains compliant with the tax laws and regulations in their area.

With a team comprised of CPAs, MBAs, former auditors, and CMIs (highly designated tax professionals) as well as a collective century of experience across all of them, businesses that choose to engage the services of Ampersand Accounting are in very capable hands.

Final Thoughts on Amazon Accountants

Most professional accounting services will offer you general guidance on the most common procedures. They may even give you advice on how to save money based on current practices. Only specialized Amazon accounting services, however, can answer your specific needs. They also give you proactive recommendations that can save you a lot down the line.

About EcomBalance

EcomBalance is a monthly bookkeeping service for eCommerce companies. EcomBalance handles your bookkeeping and sends you a Profit and Loss Statement, Balance Sheet, and Cash Flow Statement by the 15th of each month. EcomBalance also has a sister company, AccountsBalance, that caters to agencies, software companies, coaches, and other online companies.